Most people put off estate planning until it’s too late. They don’t want to think about death, and they figure that if something happens, their loved ones will take care of everything. But that’s not always the case. Without a will or other estate planning documents in place, your loved ones could end up fighting over your possessions–or worse, they might not know what you wanted done with your things after you’re gone. Estate planning can provide peace of mind that your wishes will be followed and that your loved ones won’t have to deal with additional stress during a difficult time.

Estate planning isn’t just about writing a will; it’s also about taking steps to make sure that you and your family are taken care of in the event of an unexpected death or disability. This can include making sure that your assets are properly invested, setting up a trust to protect your money, and creating an advance healthcare directive so that your wishes for end-of-life care are known.

Estate planning is a critical step in ensuring that your wishes are followed after you’re gone. Here are five steps to take to help you get started:

- Gather Important Documents – Before you begin any estate planning, it’s important to gather all of the documents that pertain to your finances, property, and health care. This includes bank statements, real estate documents, life insurance policies, and powers of attorney.

- Choose a Trustee – A trustee is the person responsible for carrying out your wishes after you’re gone. Make sure to choose someone who is reliable and trustworthy and who can handle the responsibility of managing your estate.

- Write a Will – Your will is the most important part of your estate plan, so make sure to write one that clearly states your wishes. This includes what happens to your possessions after you’re gone and who should receive them. Be sure to include provisions for any minor children you have as well.

- Set Up a Trust – A trust is a legal entity that can be used to protect your assets and provide for your family after you’re gone. You can also use it to manage how your money is invested and distributed.

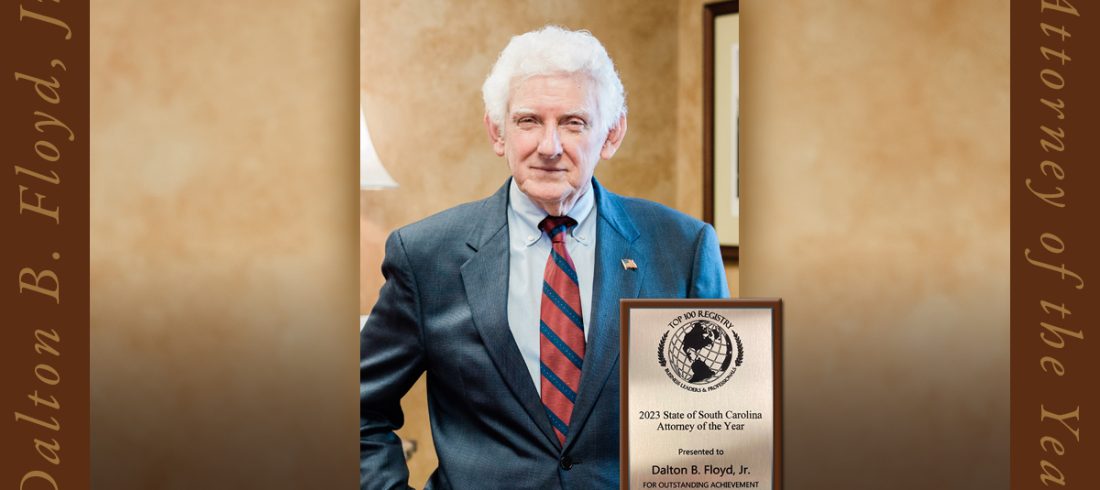

- Get Help from an Estate Planning Attorney – Having the assistance of an experienced estate planning attorney can help ensure that your estate plan is properly executed and that all of your wishes are followed. The Floyd Law Firm in Surfside Beach, SC has years of experience helping clients with their estate planning needs.

Tax considerations for your loved ones

Estate planning is also important for tax considerations for your loved ones. Every state has different laws about how taxes are handled when someone dies, and estate planning can help you ensure that your loved ones don’t have to pay more taxes than necessary.

In South Carolina, the deceased’s estate must go through probate in order to settle any debts and distribute assets according to the Will. The executor of the estate is responsible for ensuring that all relevant taxes are paid on behalf of the deceased. This includes federal income taxes, estate taxes, and gift taxes. The state of South Carolina also has its own inheritance tax, which must be paid by the beneficiaries of the estate.

Estate planning can be a daunting process, but it’s important to make sure that you have an organized plan in place for when the time comes. With the help of the professionals at The Floyd Law Firm in Surfside Beach, SC, you can be sure that your wishes will be carried out and that your family is taken care of. Contact us today to get started. With the right guidance, estate planning can help provide peace of mind for both you and your family.

Learn More

Estate Planning, Wills and Trusts

Probate & Estate Administration

Estate Planning: Preparing for your attorney meeting