A Power of Attorney is simply a power given to an Agent by a Principal to allow the Agent to act on behalf of the Principal. One of the problems with the Standard Power of Attorney is that the Power is valid only to the extent that the Principal could have acted at the time the Power is exercised.

For example, suppose John Smith (Principal) gives to his wife, Betty Smith (Agent), a Simple Power of Attorney which on its face enables Betty to act on behalf of John in respect to a wide variety of matters. Suppose further that John is then placed in a hospital and develops an incapacitating mental disability, whether temporary or permanent. Since John would not be able to contract at such time since he does not have the required mental capacity to enter into such a contract, Betty would likewise be unable to contract for John under her current Power of Attorney.

Thus, when a Power of Attorney was most needed, it would have become inoperative. In such cases, the appointment of a Conservator often appears to be the only alternative for managing the incompetent’s estate. The procedures for the appointment of a Conservator, however, can be expensive, time consuming, and unpleasant.

Unhappiness with the rule terminating or suspending a Power of Attorney upon the incapacity of the Principal has resulted in statutory changes in a number of states – including South Carolina. These changes permit a Power of Attorney to continue despite the Principal’s incompetence, if the Power expressly provides that it survives incompetency and meets certain other statutory requirements. Because these Powers survive incompetency, they are frequently referred to as “Durable Powers of Attorney”.

What does South Carolina Law require for a Durable Power of Attorney?

The South Carolina Durable Power of Attorney Act, which was signed by the Governor into law in 1978, does not make all Powers of Attorney durable. Only those that meet certain rigid statutory requirements will be construed as Durable Powers. The formal requirements of the statute relate to:

- The specific language that must be included in the instrument creating the Durable Power of Attorney

- The manner in which the instrument must be executed, witnessed, attested, and probated

- The recordation of the instrument in the public records

What relationship does the Agent – often referred to as the “Attorney-in-fact” – have with the Principal?

The Act provides that the “Attorney-in-fact shall have a fiduciary relationship with the Principal and shall be accountable and responsible as a fiduciary”. The language appears to incorporate the law applicable to fiduciaries generally into the relationship between the Principal and the Attorney-in-fact. Simply stated, since the Attorney-in-fact acts as a fiduciary to the Principal, the law will charge the principal with certain responsibilities of acting reasonably and in good faith.

May a Durable Power of Attorney be revoked?

As long as the Principal remains competent, he or she may revoke the Durable Power of Attorney at will. After the onset of incompetency, however, his or her contractual disability would prevent him or her from both entering or voiding contracts. Revocation of the Power prior to incompetency, as between Principal and Agent, is not difficult – but problems may arise when innocent third parties deal with an Attorney-in-fact who does not reveal that his or her authority has been revoked. These problems, however, are not peculiar to the Durable Power.

Although the death of the Principal revokes the authority of the Agent, even under a Durable Power authorized by the Act, other statutes give validity to the acts of the Agent if an innocent third party was unaware of the death of the Principal at the time the Agent acted. Moreover, the affidavit of the Attorney-in-fact attesting to a lack of actual knowledge or notice of the Principal’s death is, in the absence of fraud, conclusive proof of the absence of such knowledge or notice by such Attorney-in-fact.

The effective resignation of the Attorney-in-fact will also terminate the agency. Because of the Attorney-in-fact fiduciary relationship to the Principal, however, it is not questionable whether the Attorney-in-fact can resign after the onset of incompetency if the resignation would be a detriment to the incompetent Principal.

Who needs a Durable Power of Attorney?

The answer to this question might be, who will become incompetent. Statistics tell us that although disability, unlike death, is not a certainty – it is far more likely to occur to the average person at any point in time prior to death. For these reasons, the problem of disability demands the attention of estate planners and their clients. Ignoring the likelihood of disability may well result in a defeat of an elaborate estate plan and may cost the client money and flexibility.

What may an Attorney-in-fact do while operating under a Durable Power of Attorney?

An individual has broad discretion to delegate to other persons the power to act on his or her behalf. It is generally held that whatever a person can do themselves may also be done through another as their Agent. Some rather narrow exceptions do exist, however, for certain acts are said to be so peculiarly personal that they cannot be delegated. For example, contracting for marriage and making a Will are nondelegable acts. For the most part, the Attorney-in-fact acting through a Durable Power of Attorney has virtually unlimited power to act.

A General Power of Attorney can be used as a device for the management of assets under which the incompetent’s estate that are not held in Trust, can be managed by an individual – frequently a spouse or other family member.

The Attorney-in-fact can also be given the power, under a Durable Power of Attorney, to effect the custody and control of the Principal during the Principal’s lifetime. When mental incompetency arises, attention is normally directed towards legal problems of asset management, but sometimes even greater problems of the physical care of the incompetent are also presented. The Durable Power of Attorney may provide the means by which persons can plan for their care and control if incompetency arises.

This, the Durable Power of Attorney can contain provisions relating not only to asset management, but also to the care, custody, and control of the incompetent. Use of this Power can greatly alleviate problems and facilitate the enterprise of caring for an incompetent and his or her estate. The Power can permit the Attorney-in-fact, for example, to retain and dismiss a variety of professional help – medical, legal, accounting, and so on. The Attorney-in-fact can consent to those types of medical or surgical treatment and procedures for which consent is required.

Because it is now possible for the life of an individual to be artificially prolonged by medical technology even though the brain function has irreversibly ceased – substantial concern and debate has arisen over the moral, legal, and ethical questions involved in such circumstances. Legislatures have been prompted to adopt statutes that permit an individual to request or require that they are not kept alive artificially if their brain function has irrevocably ceased. The Death With Dignity Act was passed in South Carolina, allowing those who would like to determine when life-sustaining procedures may be withheld to do so if they have a signed Declaration. It may be, however, if no Declaration was signed prior to incompetency, the individual could be provided for via a properly drafted Durable Power of Attorney to be utilized to authorize an Attorney-in-fact to prohibit various kinds of medical treatment under circumstances when the Principal does not desire to receive such treatment.

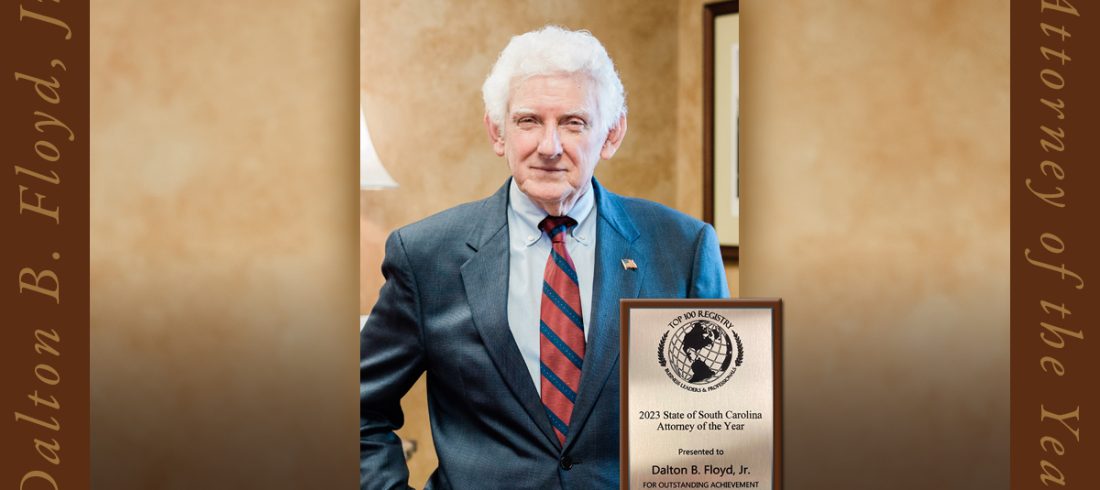

At The Floyd Law Firm PC, we are focused on developing estate plans that are specifically tailored to each individual client’s needs. An effective estate plan can include a Will, trusts, powers of attorney for healthcare and property decisions, and advance health directives such as living wills and healthcare proxy.